Introduction

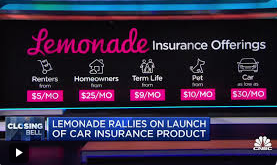

In the ever-evolving world of insurance, Lemonade has emerged as a disruptive force, challenging traditional models with its innovative approach. While initially known for its homeowners and renters insurance offerings, Lemonade has now ventured into the realm of auto coverage with its Lemonade car insurance product. This comprehensive guide will delve into the intricacies of Lemonade’s car insurance, exploring how it stands out in the crowded auto insurance market.

Car insurance is a crucial aspect of vehicle ownership, providing financial protection against accidents, theft, and other unforeseen events. As the automotive landscape shifts towards electric and autonomous vehicles, insurance providers must adapt to meet new challenges and opportunities. Lemonade’s entry into this space brings a fresh perspective, leveraging technology and artificial intelligence to reimagine the car insurance experience.

As we explore Lemonade car insurance, we’ll uncover how this digital-first insurer is aiming to simplify the often complex world of auto coverage. From its unique underwriting process to its eco-friendly initiatives, Lemonade’s approach to car insurance promises a blend of convenience, affordability, and social responsibility that may appeal to modern drivers.

What is Lemonade Car Insurance?

Lemonade car insurance is a digital-first auto insurance product offered by Lemonade, a company known for its innovative approach to insurance. At its core, Lemonade car insurance provides the standard coverages you’d expect from any auto insurance policy, such as liability, collision, and comprehensive coverage. However, what sets it apart is the way it leverages technology to streamline the entire insurance process, from getting a quote to filing a claim.

Unlike traditional car insurance providers, Lemonade operates primarily through a mobile app and website, eliminating the need for in-person meetings or phone calls with insurance agents. This digital approach allows for a more efficient and often more cost-effective insurance experience. Here are some key features that define Lemonade’s car insurance offering:

- AI-powered underwriting: Lemonade uses artificial intelligence to assess risk and determine premiums, potentially leading to more accurate and personalized pricing.

- Instant quotes: Through the Lemonade app, users can receive a car insurance quote in minutes by answering a series of questions about their vehicle and driving history.

- Fast claims processing: The company boasts the ability to handle many claims instantly, with some being paid out in as little as a few seconds, thanks to its AI-driven claims system.

- Telematics integration: Lemonade car insurance can use data from your smartphone to assess your driving habits, potentially offering discounts for safe driving.

- Eco-friendly focus: The company offers special discounts for electric and hybrid vehicles, aligning with its commitment to environmental sustainability.

One of the most distinctive aspects of Lemonade’s car insurance model is its approach to profits. The company takes a flat fee from each premium and uses the rest to pay claims and purchase reinsurance. Any money left over is donated to charities chosen by policyholders, a model Lemonade calls the “Giveback” program. This unique structure aims to align the interests of the insurer with those of its customers, potentially reducing the incentive for the company to deny claims.

It’s important to note that while Lemonade car insurance offers a modern twist on auto coverage, it still provides the fundamental protections required by law and desired by most drivers. The difference lies in how these protections are delivered and managed, with a focus on user experience, transparency, and social responsibility.

As we delve deeper into the specifics of Lemonade car insurance in the following sections, we’ll explore how this innovative approach translates into real-world benefits for policyholders, as well as any potential drawbacks to consider when evaluating Lemonade as your auto insurance provider.

Certainly. I’ll continue with the next sections of the blog post:

How Lemonade Car Insurance Works

Understanding the mechanics of Lemonade car insurance is crucial for potential policyholders. The company’s approach leverages technology to simplify and streamline the entire insurance process, from application to claims. Let’s break down how Lemonade car insurance operates:

The Application Process

Applying for Lemonade car insurance is designed to be quick and straightforward:

- Download the app: Everything starts with the Lemonade mobile app, available for both iOS and Android devices.

- Answer questions: The app guides you through a series of questions about your vehicle, driving history, and personal details.

- AI analysis: Lemonade’s AI, named Maya, analyzes your responses and assesses your risk profile.

- Receive quote: Within minutes, you’ll receive a personalized quote for your car insurance.

- Customize coverage: You can adjust coverage levels and add-ons to suit your needs.

- Purchase policy: If you’re satisfied with the quote, you can purchase the policy directly through the app.

This digital-first approach eliminates the need for lengthy phone calls or in-person meetings, making the process more efficient for tech-savvy consumers.

Using AI and Technology in Underwriting and Claims

Lemonade’s car insurance heavily relies on artificial intelligence and machine learning algorithms to assess risk and process claims. Here’s how technology plays a role:

- Underwriting: AI analyzes numerous data points to determine risk and set premiums, potentially leading to more accurate pricing.

- Claims processing: Many claims can be handled instantly by AI, with some simple claims paid out in seconds.

- Fraud detection: Machine learning algorithms help identify potential fraudulent claims more effectively.

- Personalized pricing: Telematics data from your smartphone can be used to offer discounts based on your actual driving behavior.

Lemonade’s Mobile App and Its Features for Car Insurance Customers

The Lemonade mobile app is the central hub for managing your Lemonade car insurance policy. Key features include:

- Policy management: View and adjust your coverage, add or remove vehicles, and access policy documents.

- Claims filing: Submit claims directly through the app, including the ability to upload photos and videos.

- Digital ID cards: Access your insurance ID card digitally for easy proof of insurance.

- Roadside assistance: Request help for breakdowns, lockouts, or other emergencies.

- Telematics: If enabled, the app can track your driving habits to potentially earn you safe driving discounts.

By centralizing these features in a mobile app, Lemonade aims to provide a more convenient and user-friendly experience for its car insurance customers.

Coverage Options with Lemonade Car Insurance

Lemonade car insurance offers a range of coverage options to protect drivers in various situations. While the specifics may vary by state, here’s an overview of the typical coverage options available:

Liability Coverage

Liability coverage is the foundation of any car insurance policy and is required by law in most states. Lemonade’s car insurance liability coverage includes:

- Bodily Injury Liability: Covers injuries you cause to others in an accident where you’re at fault.

- Property Damage Liability: Pays for damage you cause to other people’s property, including their vehicles.

Collision Coverage

Collision coverage pays for damage to your own vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. This is optional but often required if you’re financing or leasing your vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related incidents such as:

- Theft

- Vandalism

- Fire

- Natural disasters

- Falling objects

- Animal-related damage

Personal Injury Protection

Personal Injury Protection (PIP) covers medical expenses for you and your passengers, regardless of who is at fault in an accident. It may also cover lost wages and other related expenses. PIP is required in some states and optional in others.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re in an accident with a driver who either has no insurance or doesn’t have enough insurance to cover the damages they caused. It typically includes:

- Uninsured Motorist Bodily Injury: Covers your medical expenses if an uninsured driver injures you.

- Uninsured Motorist Property Damage: Pays for damage to your vehicle caused by an uninsured driver.

- Underinsured Motorist Coverage: Provides additional coverage if the at-fault driver’s insurance is insufficient to cover your damages.

Additional Coverage Options

Lemonade car insurance also offers several optional coverages to enhance your policy:

- Roadside Assistance: Provides help if your car breaks down, you run out of gas, or you’re locked out of your vehicle.

- Rental Car Coverage: Covers the cost of a rental car while your vehicle is being repaired after a covered claim.

- Glass Coverage: Pays for repair or replacement of your windshield and other auto glass, often with no deductible.

- Gap Insurance: Covers the difference between your car’s actual cash value and what you owe on your loan or lease if your car is totaled.

It’s important to note that the availability of these coverages and their specific terms may vary depending on your state and individual circumstances. When considering Lemonade car insurance, it’s advisable to carefully review the coverage options available to you and select those that best meet your needs and budget.

Pricing and Discounts for Lemonade Car Insurance

One of the most attractive aspects of Lemonade car insurance is its potential for competitive pricing. The company’s use of AI and a streamlined digital process allows for potentially lower overhead costs, which can translate to savings for customers. However, as with any insurance provider, several factors influence the final price of your policy.

Factors Affecting Lemonade Car Insurance Rates

When determining your premium, Lemonade’s car insurance algorithm considers various factors, including:

- Driving record: Your history of accidents, tickets, and claims

- Vehicle type: The make, model, age, and value of your car

- Annual mileage: How much you drive each year

- Location: Where you live and park your car

- Age and experience: Your age and how long you’ve been driving

- Credit score: In states where it’s allowed, your credit history may be considered

- Coverage levels: The types and amounts of coverage you choose

Available Discounts and How to Qualify

Lemonade car insurance offers several discounts to help reduce your premium:

| Discount | Description | How to Qualify |

|---|---|---|

| Safe Driver Discount | Reward for maintaining a clean driving record | No accidents or moving violations for a specified period |

| Good Student Discount | Savings for young drivers with good grades | Maintain a B average or higher in school |

| Multi-Car Discount | Reduced rates for insuring multiple vehicles | Insure more than one car with Lemonade |

| Bundling Discount | Savings for combining car insurance with other Lemonade policies | Have multiple Lemonade insurance products (e.g., home and auto) |

| Electric/Hybrid Vehicle Discount | Lower rates for eco-friendly vehicles | Own or lease an electric or hybrid car |

| Telematics Discount | Savings based on safe driving habits | Use Lemonade’s app to track your driving behavior |

Comparison with Traditional Car Insurance Pricing

While Lemonade’s car insurance pricing can be competitive, it’s important to compare quotes from multiple providers to ensure you’re getting the best deal. Here’s how Lemonade’s pricing model might differ from traditional insurers:

- Lower overhead costs: Lemonade’s digital-first approach may lead to cost savings that can be passed on to customers.

- More dynamic pricing: The use of AI and telematics allows for more frequent adjustments to premiums based on driving behavior.

- Transparency: Lemonade’s flat fee model provides clarity on how much of your premium goes towards potential claims versus company profit.

- Potential for rapid changes: As a newer player in the car insurance market, Lemonade’s rates may be subject to more frequent adjustments as they refine their pricing models.

It’s worth noting that while Lemonade car insurance may offer competitive rates for many drivers, it may not always be the cheapest option. Factors such as your specific risk profile and location can significantly impact how Lemonade’s rates compare to other insurers.

The Claims Process with Lemonade Car Insurance

One of the most innovative aspects of Lemonade car insurance is its approach to claims processing. The company leverages AI to streamline the claims experience, aiming to make it faster and more efficient than traditional methods.

How to File a Claim

Filing a claim with Lemonade’s car insurance is designed to be straightforward:

- Open the Lemonade app: All claims start through the mobile application.

- Hit the “Claim” button: This initiates the claims process.

- Answer questions: The AI chatbot, Jim, will ask you a series of questions about the incident.

- Provide evidence: You may be asked to upload photos or videos of the damage.

- AI assessment: For simple claims, AI may be able to approve and pay out instantly.

- Human review: More complex claims are forwarded to human adjusters for review.

AI-Powered Claims Processing

Lemonade’s car insurance uses artificial intelligence to handle many aspects of the claims process:

- Initial assessment: AI analyzes the claim details to determine if it can be processed automatically or needs human review.

- Fraud detection: Machine learning algorithms help identify potential fraudulent claims.

- Damage estimation: For some claims, AI can estimate repair costs based on uploaded photos and data.

- Instant payouts: Simple, straightforward claims may be approved and paid out immediately by the AI system.

Timeframes for Claim Resolution

The time it takes to resolve a claim with Lemonade car insurance can vary:

- Instant claims: Some simple claims may be resolved and paid out in as little as a few seconds.

- Standard claims: More typical claims might take a few days to a couple of weeks to process.

- Complex claims: Claims involving severe damage, injuries, or multiple parties may take several weeks or longer to resolve.

It’s important to note that while Lemonade aims for quick resolutions, the actual timeframe can depend on various factors, including the complexity of the claim and the need for additional information or investigation.

Customer Experiences with Lemonade Car Insurance Claims

While individual experiences can vary, many customers report positive experiences with Lemonade’s car insurance claims process:

“I was amazed at how quick and easy it was to file a claim after my fender bender. The app guided me through the process, and I received approval for repairs within hours.” – Sarah T., Lemonade customer

However, it’s important to consider that as a relatively new player in the car insurance market, Lemonade’s claims handling capabilities are still evolving. Some customers have reported challenges with more complex claims or situations that fall outside the AI’s capabilities.

As with any insurance provider, it’s crucial to thoroughly document any incidents and communicate clearly with the claims team to ensure a smooth process. While Lemonade’s car insurance claims system offers the potential for faster resolutions in many cases, customers should be prepared for the possibility that more complicated situations may require additional time and human intervention.

Pros and Cons of Lemonade Car Insurance

As with any insurance product, Lemonade car insurance comes with its own set of advantages and potential drawbacks. Let’s explore these to help you make an informed decision:

Advantages of Choosing Lemonade for Auto Coverage

- Tech-driven efficiency: The AI-powered application and claims processes can save time and hassle.

- Potential cost savings: Lower overhead costs may translate to competitive premiums for some drivers.

- User-friendly mobile app: Manage your policy, file claims, and access insurance documents easily from your smartphone.

- Transparent business model: Lemonade’s flat fee structure and Giveback program offer clarity on how premiums are used.

- Quick claims processing: Some claims can be paid out instantly, thanks to AI technology.

- Eco-friendly focus: Discounts for electric and hybrid vehicles align with environmental consciousness.

- Bundling options: Potential for additional savings when combining with other Lemonade insurance products.

Potential Drawbacks or Limitations

- Limited availability: Lemonade car insurance is not yet available in all states.

- Lack of in-person service: Those who prefer face-to-face interactions may find the digital-only approach challenging.

- Newer to the auto insurance market: Less established track record compared to traditional insurers.

- Potential for technical issues: Reliance on technology means any app or system outages could be problematic.

- May not be the cheapest option: Despite potential savings, rates may not always be the lowest for all drivers.

- Less flexibility for complex situations: The AI-driven model may struggle with unique or complicated insurance needs.

Who Might Benefit Most from Lemonade Car Insurance

Lemonade car insurance may be particularly well-suited for:

- Tech-savvy drivers comfortable with managing insurance entirely through an app

- Those who value quick, efficient processes and minimal paperwork

- Drivers of electric or hybrid vehicles looking for specific discounts

- Individuals who already have other Lemonade insurance products and want to bundle

- People who appreciate Lemonade’s social impact model and Giveback program

- Drivers with straightforward insurance needs that fit well within Lemonade’s offerings

Lemonade Car Insurance vs. Traditional Auto Insurance Providers

To fully understand the value proposition of Lemonade car insurance, it’s helpful to compare it with traditional auto insurance providers. Here’s a breakdown of key differences:

Key Differences in Approach and Technology

| Aspect | Lemonade Car Insurance | Traditional Auto Insurers |

|---|---|---|

| Business Model | Digital-first, AI-driven | Often a mix of digital and traditional methods |

| Application Process | Entirely through mobile app or website | Often involves phone calls or in-person meetings |

| Claims Processing | AI-powered, with potential for instant payouts | Usually involves human adjusters, longer processing times |

| Policy Management | Self-service through app | May require contacting an agent for changes |

| Use of Technology | Heavy reliance on AI and machine learning | Varying degrees of technology adoption |

Customer Service Comparisons

Lemonade car insurance takes a different approach to customer service:

- Lemonade: Primarily chatbot and AI-driven support, with human backup for complex issues. 24/7 availability through the app.

- Traditional Insurers: Often offer a mix of phone support, in-person agents, and digital tools. May have more extensive human support but potentially longer wait times.

Customer preference often depends on individual comfort with technology and the desire for personal interactions.

Coverage and Pricing Comparisons

While specific comparisons will vary based on individual circumstances, here are some general observations:

- Coverage Options: Lemonade offers standard coverage types similar to traditional insurers. However, some traditional insurers may offer more specialized coverage options or add-ons.

- Pricing: Lemonade’s pricing can be competitive, especially for tech-savvy drivers or those with clean records. However, traditional insurers may offer more discount options based on their longer history and larger customer base.

- Customization: Traditional insurers might provide more flexibility for customizing policies, especially for drivers with unique needs.

- Financial Stability: Established insurers often have a longer track record of financial stability, which can be a consideration for some customers.

It’s important to note that the insurance landscape is continually evolving, with many traditional insurers adopting more technology-driven approaches. As Lemonade car insurance grows and traditional insurers innovate, the distinctions between them may become less pronounced over time.

Ultimately, the choice between Lemonade and a traditional auto insurer will depend on your individual needs, preferences, and circumstances. It’s always advisable to compare quotes and coverage options from multiple providers to find the best fit for your situation.

Lemonade’s Eco-Friendly Initiatives in Car Insurance

Lemonade car insurance has positioned itself as an environmentally conscious option in the auto insurance market. This approach aligns with growing consumer demand for eco-friendly products and services across industries. Let’s explore how Lemonade incorporates sustainability into its car insurance offerings:

Discounts for Electric and Hybrid Vehicles

One of the most direct ways Lemonade car insurance promotes eco-friendly driving is through its discount program for electric and hybrid vehicles:

- Electric Vehicle Discount: Owners of fully electric vehicles may qualify for a significant discount on their premiums.

- Hybrid Vehicle Discount: Drivers of hybrid cars can also benefit from reduced rates, though typically not as substantial as the electric vehicle discount.

- Rationale: These discounts reflect the lower environmental impact of these vehicles and potentially lower risk profiles associated with their drivers.

The exact discount percentages may vary based on factors such as location and specific vehicle models, but they can represent significant savings for environmentally conscious drivers.

Carbon Offset Programs

Lemonade has implemented a carbon offset program as part of its commitment to environmental sustainability:

- Automatic Enrollment: All Lemonade car insurance policies are automatically enrolled in the company’s carbon offset program.

- How It Works: Lemonade calculates the estimated carbon emissions from each insured vehicle and purchases corresponding carbon offsets.

- Offset Projects: The company invests in various environmental projects, such as reforestation or renewable energy initiatives, to neutralize the carbon footprint of insured vehicles.

- No Additional Cost: This program is included at no extra charge to policyholders, making it an effortless way for customers to contribute to environmental causes.

How Lemonade Car Insurance Supports Sustainability

Beyond discounts and carbon offsets, Lemonade’s car insurance model incorporates several other sustainability-focused elements:

- Paperless Policies: By operating entirely digitally, Lemonade reduces paper waste associated with traditional insurance documentation.

- Promoting Responsible Driving: The use of telematics to offer safe driving discounts can encourage more efficient and eco-friendly driving habits.

- Efficient Claims Process: The AI-driven claims system potentially reduces the need for in-person inspections, cutting down on transportation-related emissions.

- Giveback Program: While not exclusively focused on environmental causes, Lemonade’s Giveback program allows policyholders to direct unused premiums to various charities, including environmental organizations.

“At Lemonade, we believe that insurance companies have a responsibility to address climate change. Our car insurance product is designed not just to protect drivers, but also to promote and reward eco-friendly choices.” – Daniel Schreiber, Lemonade CEO and Co-founder

While these initiatives demonstrate Lemonade’s commitment to sustainability, it’s important for consumers to consider their overall insurance needs and compare offerings from multiple providers to ensure they’re getting the best coverage for their situation.

State Availability and Regulations for Lemonade Car Insurance

As a relatively new entrant in the auto insurance market, Lemonade car insurance is not yet available in all U.S. states. The company has been gradually expanding its service area, but availability remains limited compared to more established insurers.

List of States Where Lemonade Car Insurance is Available

As of the last update, Lemonade car insurance is available in the following states:

- Illinois

- Tennessee

- Ohio

- Oregon

- Georgia

- Texas

- Pennsylvania

- Maryland

- Virginia

Note: This list is subject to change as Lemonade expands its services. Always check the official Lemonade website or contact them directly for the most up-to-date information on availability in your state.

State-Specific Requirements and How Lemonade Complies

Auto insurance regulations vary significantly from state to state. Lemonade car insurance must comply with the specific requirements of each state where it operates:

- Minimum Coverage Requirements: Lemonade ensures that its policies meet or exceed the minimum coverage levels mandated by each state.

- Rate Approval: In many states, insurance rates must be approved by the state’s insurance department. Lemonade works with regulators to ensure its pricing models comply with state laws.

- Consumer Protection Laws: The company adheres to state-specific consumer protection regulations, which may include rules about policy cancellations, renewals, and claims handling.

- Licensing: Lemonade obtains the necessary licenses to operate as an insurance provider in each state.

Plans for Expansion to Other States

Lemonade has expressed intentions to continue expanding its car insurance offerings to more states:

- Gradual Rollout: The company typically introduces its car insurance product state by state, allowing for careful scaling and adjustment to local markets.

- Regulatory Hurdles: Expansion speed is often dependent on navigating the regulatory landscape in each new state.

- Target Markets: While specific plans are not always public, Lemonade often prioritizes states with large populations or those where it already offers other insurance products.

Potential customers in states where Lemonade car insurance is not yet available can sign up for notifications on the company’s website to be informed when the service becomes available in their area.

It’s worth noting that the limited availability of Lemonade’s car insurance can be a significant drawback for some consumers, particularly those who move frequently or have vehicles registered in multiple states. As the company continues to expand, this limitation may become less of an issue over time.

Certainly. I’ll continue with the next sections of the blog post:

Customer Reviews and Satisfaction with Lemonade Car Insurance

Understanding customer experiences is crucial when evaluating any insurance provider. As a relatively new player in the auto insurance market, Lemonade car insurance has been garnering attention and feedback from early adopters. Let’s explore what customers are saying about their experiences.

Analysis of Customer Feedback

Customer reviews of Lemonade car insurance tend to highlight several key aspects of the service:

- Ease of Use: Many customers praise the user-friendly mobile app and straightforward process for getting quotes and managing policies.

- Quick Claims Processing: Several reviews mention positive experiences with fast claims settlement, particularly for minor incidents.

- Competitive Pricing: A number of customers report finding lower rates with Lemonade compared to their previous insurers.

- Appreciation for the Business Model: The transparency of Lemonade’s flat fee structure and Giveback program resonates with many customers.

- Tech-Forward Approach: Tech-savvy customers often appreciate the AI-driven processes and digital-first approach.

Common Praises and Complaints

Here’s a breakdown of frequently mentioned positives and negatives in customer reviews:

| Praises | Complaints |

|---|---|

| Fast and easy application process | Limited availability in some states |

| Competitive rates for many drivers | Occasional app glitches or technical issues |

| Rapid claims processing for simple cases | Less personalized service compared to traditional agents |

| Transparent pricing and business model | Some complex claims taking longer to resolve |

| Eco-friendly initiatives | Limited options for very specialized coverage needs |

Comparison with Industry Satisfaction Benchmarks

While Lemonade car insurance is still relatively new and may not be included in all industry-wide satisfaction surveys, we can make some general comparisons:

- J.D. Power Ratings: As of the last update, Lemonade has not yet been included in J.D. Power’s auto insurance satisfaction studies, which are widely regarded in the industry.

- Better Business Bureau (BBB): Lemonade has an A+ rating from the BBB, though this reflects the company’s response to complaints rather than overall customer satisfaction.

- Online Review Platforms: On various online review platforms, Lemonade generally receives positive ratings, often scoring above 4 out of 5 stars. However, these ratings usually reflect all of Lemonade’s insurance products, not just car insurance.

“I switched to Lemonade for my car insurance last year and have been impressed with how easy everything is. The app is great, and I saved about 20% compared to my old policy. When I had a small fender bender, the claim was handled quickly. It’s definitely a different experience from traditional insurance.” – Mark R., Lemonade customer

It’s important to note that customer experiences can vary widely based on individual circumstances, and online reviews may not always provide a complete picture. As Lemonade car insurance continues to grow and serve more customers, a clearer picture of overall customer satisfaction should emerge.

Tips for Getting the Best Deal on Lemonade Car Insurance

If you’re considering Lemonade car insurance, there are several strategies you can employ to potentially lower your premiums and get the best value for your coverage. Here are some tips to keep in mind:

How to Optimize Your Application

- Provide Accurate Information: Be truthful and precise when answering questions about your driving history, vehicle, and personal details.

- Consider Your Coverage Needs: While it’s important to have adequate coverage, avoid over-insuring if you don’t need it.

- Opt for a Higher Deductible: Choosing a higher deductible can lower your premium, but make sure you can afford the out-of-pocket expense if you need to make a claim.

- Use Telematics: If available, opt into Lemonade’s telematics program to potentially earn discounts based on your driving habits.

Maximizing Available Discounts

Take advantage of all discounts you’re eligible for:

- Bundle Policies: Combine your car insurance with other Lemonade products like homeowners or renters insurance.

- Safe Driver Discount: Maintain a clean driving record to qualify for lower rates.

- Good Student Discount: If you’re a student, maintain good grades to potentially qualify for savings.

- Electric/Hybrid Vehicle Discount: If you drive an eco-friendly vehicle, make sure this is noted in your application.

- Pay-in-Full Discount: Consider paying your entire premium upfront if Lemonade offers a discount for this.

Balancing Coverage and Cost

Finding the right balance between comprehensive coverage and affordable premiums is key:

- Assess Your Needs: Consider factors like your vehicle’s value, your driving habits, and your financial situation when choosing coverage levels.

- Review Regularly: As your circumstances change, reassess your coverage needs and adjust accordingly.

- Compare Quotes: While Lemonade aims to offer competitive rates, it’s always wise to compare quotes from multiple insurers to ensure you’re getting the best deal.

- Consider Long-Term Costs: Sometimes, paying a bit more for better coverage can save money in the long run if you need to make a claim.

Remember, while getting a good deal is important, the cheapest option isn’t always the best. Ensure that your Lemonade car insurance policy provides adequate protection for your needs while also fitting your budget.

The Future of Lemonade Car Insurance

As a tech-forward company, Lemonade car insurance is likely to continue evolving and innovating in the auto insurance space. While specific plans are subject to change, we can speculate on potential developments based on industry trends and Lemonade’s approach to insurance:

Planned Features and Improvements

- Enhanced AI Capabilities: Lemonade may further refine its AI algorithms to provide even more accurate pricing and faster claims processing.

- Advanced Telematics: The company could expand its usage-based insurance offerings, potentially incorporating more sophisticated driving behavior analysis.

- Expanded Coverage Options: As Lemonade grows in the auto insurance market, it may introduce more specialized coverage options to cater to a wider range of customer needs.

- Improved Self-Service Features: The mobile app and online platform may see enhancements to allow customers even greater control over their policies.

Integration with Other Lemonade Insurance Products

Lemonade car insurance is likely to become more tightly integrated with the company’s other insurance offerings:

- Seamless Bundling: Expect even more streamlined processes for combining auto insurance with home, renters, or pet insurance policies.

- Unified Customer Experience: A single dashboard for managing all Lemonade policies could provide a more cohesive insurance experience.

- Cross-Product Rewards: Lemonade might introduce loyalty programs or additional discounts for customers who hold multiple policies.

Potential Impact on the Auto Insurance Industry

As Lemonade car insurance continues to grow and innovate, it could influence the broader auto insurance landscape:

- Increased Digitalization: Traditional insurers may accelerate their digital transformation efforts to compete with Lemonade’s tech-forward approach.

- Greater Emphasis on Transparency: Lemonade’s flat fee model and Giveback program could push other insurers to be more transparent about how premiums are used.

- Focus on Sustainability: The industry may see a growing trend of eco-friendly initiatives and discounts for green vehicles.

- Faster Claims Processing: Competitors might invest more in AI and automation to match Lemonade’s speed in claims handling.

“We believe the future of insurance is instant, affordable, and driven by social good. Our car insurance product is just the beginning of how we’re reimagining auto coverage for the digital age.” – Shai Wininger, Lemonade President and Co-founder

Conclusion

Lemonade car insurance represents a new wave in the auto insurance industry, blending technology, transparency, and social responsibility. As we’ve explored throughout this comprehensive guide, Lemonade’s approach offers several unique features:

- A digital-first, AI-driven platform for quick quotes and claims processing

- Competitive pricing for many drivers, especially those comfortable with technology

- Eco-friendly initiatives, including discounts for electric and hybrid vehicles

- A transparent business model with the Giveback program

- Integration with other Lemonade insurance products for potential bundling discounts

However, it’s important to remember that Lemonade car insurance may not be the ideal choice for everyone. Its limited state availability, reliance on digital interactions, and relatively new presence in the auto insurance market could be drawbacks for some consumers.

When considering Lemonade for your car insurance needs, it’s crucial to:

- Compare quotes and coverage options with other insurers

- Carefully assess your specific insurance requirements

- Consider your comfort level with a primarily digital insurance experience

- Check availability in your state

As the auto insurance landscape continues to evolve, Lemonade car insurance is positioned to play a significant role in shaping the future of the industry. Whether it becomes your insurer of choice or not, its innovative approach is likely to influence how we think about and purchase car insurance in the years to come.

FAQs About Lemonade Car Insurance

- Is Lemonade car insurance available in my state?Availability varies. As of the last update, Lemonade car insurance is available in select states including Illinois, Tennessee, Ohio, Oregon, Georgia, Texas, Pennsylvania, Maryland, and Virginia. Check Lemonade’s website for the most current information.

- How does Lemonade’s claims process differ from traditional insurers?Lemonade uses AI to process many claims, potentially allowing for faster payouts. Simple claims can sometimes be approved and paid instantly, while more complex cases are forwarded to human adjusters.

- Can I bundle Lemonade car insurance with other Lemonade products?Yes, Lemonade offers bundling options. You can potentially combine your car insurance with other Lemonade products like homeowners or renters insurance for additional discounts.

- What makes Lemonade car insurance eco-friendly?Lemonade offers discounts for electric and hybrid vehicles, has a carbon offset program for all policies, and operates on a largely paperless system.

- How does Lemonade use AI in its car insurance offering?Lemonade uses AI for various aspects of its service, including generating quotes, processing claims, detecting fraud, and potentially analyzing driving behavior for telematics-based discounts.

Remember, while this guide aims to provide comprehensive information about Lemonade car insurance, the insurance industry is dynamic, and offerings can change. Always verify the most current information directly with Lemonade or consult with a licensed insurance professional when making decisions about your auto insurance coverage.